change in working capital formula dcf

The Statement of Cash Flows also referred to as the cash flow statement is one of the three key financial statements that report the cash generated and spent during a specific. On the Cash Flow Statement the Change in Working Capital is defined as Old Working Capital New Working Capital where Working Capital Current.

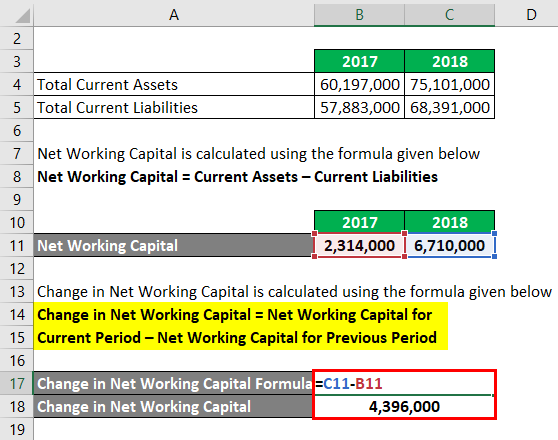

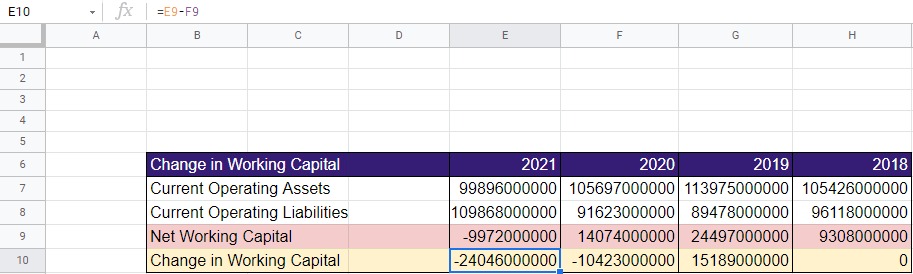

The change in net working capital formula is given as N E B where E is ending net working capital and B is beginning NWC.

. From the formula mentioned above you can calculate working capital. The change in net working capital formula is given as N E B where E is ending net working capital and B is beginning NWC. Because the change in working capital is positive it should increase FCF because it means working capital has decreased and that delays the use of cash.

Cash on hand varies for different companies but. To calculate our change in working capital we will take all the items from the assets and add them together. Therefore the variance of the data set is 3175.

Change in Working Capital Summary. However cash flow would be. ΔWorking Capital Net change in the Working Capital.

You need to calculate WC for two different years and then minus them. Valuation depends upon whether the. Then we will do the same for.

If a company purchased inventory with cash there would be no change in working capital because inventory and cash are both current assets. Here we discuss the formula to calculate and top 11. Since the change in working capital is positive you add it back to Free Cash.

Answer 1 of 6. Thus the formula for changes in non-cash working capital is. Net Present Value 36m Discounted Cash Flow Internal Rate of Return 19m Discounted Cash Flow Annuities and.

First we have to address a primary assumption on what the DCF is measuring. Say 5 then this will be 6k of your profits so you add 80k to the price 168 million plus the tax of selling 168k. Moving to cash flow statement - net.

The Quick Ratio And Current Ratio. If youre asking whether you include cash in the CA to get to change in net working capital the answer is no. In fact we would recommend that once working capital is being managed efficiently the working capital changes from year to year be estimated using working capital as a percent of revenues.

Plus tax on profits from investment portfolio also gets added to the capital. Answer 1 of 6. The formula to calculate the change in.

σ 2 64 1 16 36 16 36 4 81 8. A working capital formula is extensively used in. Once this is established your question can be answered.

Step 4 Capital Expenditures. The entire intuition behind CA-CL is to arrive at how cash has changed.

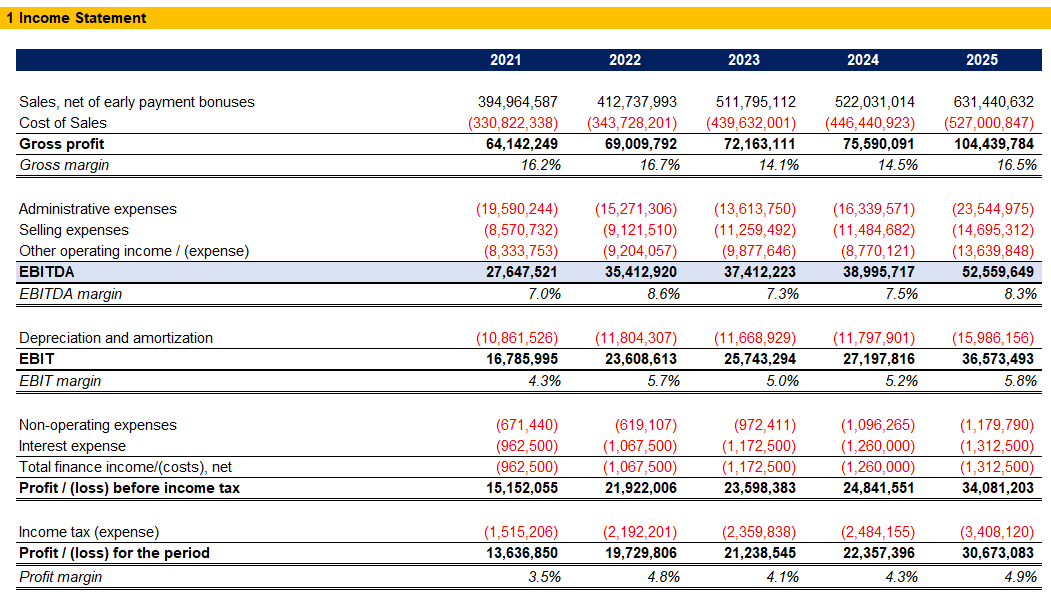

Assignment 2 Task 3 Jbinvestments

Changes In Net Working Capital All You Need To Know

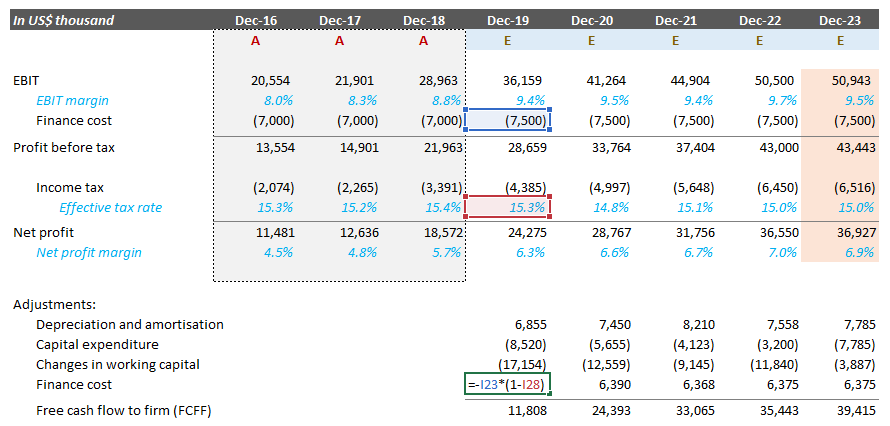

A Quick And Dirty Guide For A Discounted Cash Flow Valuation Finro Financial Consulting

Calculate Value In Use Under Ias 36 By Dobromir Dikov Fcca Magnimetrics Medium

Jae Jun Blog Changes In Working Capital And Owner Earnings The Complete Guide Talkmarkets

Changes In Net Working Capital Calculation With Example Youtube

11 Of 14 Ch 10 Change In Net Working Capital Nwc Example Youtube

Negative Working Capital Formula And Calculation

3 Statement Financial Modeling Working Capital Schedule Step 3 Youtube

Analytical Insights From Dcf Value Analysis The Footnotes Analyst

Normalised Cash Flow In Dcf Working Capital Taxes And Stable Roic Edward Bodmer Project And Corporate Finance

Change In Working Capital Video Tutorial W Excel Download

How To Calculate Your Company S Valuation Discounted Cash Flow Dcf Method

Change In Net Working Capital Formula Calculator Excel Template

Step By Step Guide On Discounted Cash Flow Valuation Model Fair Value Academy

Training Modular Financial Modeling Ii Dcf Valuations Equity Dcf Valuation Valuation Dates Cash Flow Timing Modano

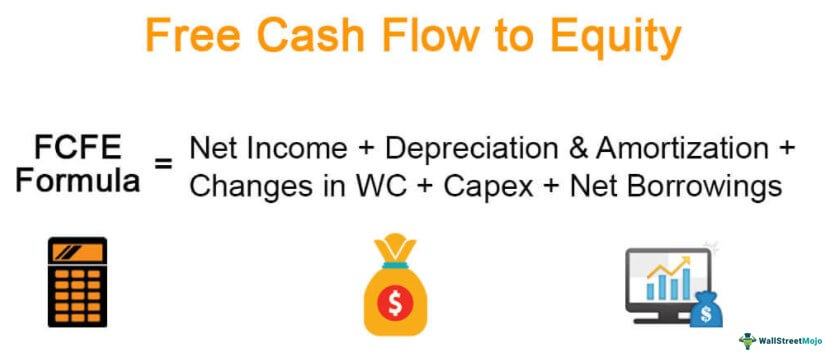

Fcfe Calculate Free Cash Flow To Equity Formula Example

Normalised Cash Flow In Dcf Working Capital Taxes And Stable Roic Edward Bodmer Project And Corporate Finance

How To Calculate Change In Working Capital Detailed Analysis Iifpia